Avride, an autonomous mobility startup spun out of Yandex's self-driving unit, has secured up to $375 million in strategic funding and commercial commitments from Uber and Nebius to rapidly scale its robotaxi and delivery robot operations. The substantial investment will enable Avride to expand to as many as 500 self-driving vehicles and broaden its geographic reach across the United States.

The funding represents one of the largest autonomous vehicle investments of 2025 and signals Uber's serious commitment to integrating robotaxis into its ride-hailing network. Avride is preparing to launch its first public robotaxi service via Uber in Dallas by the end of 2025, leveraging the partnership to accelerate real-world deployment in a major metropolitan market.

A Dual-Platform Approach

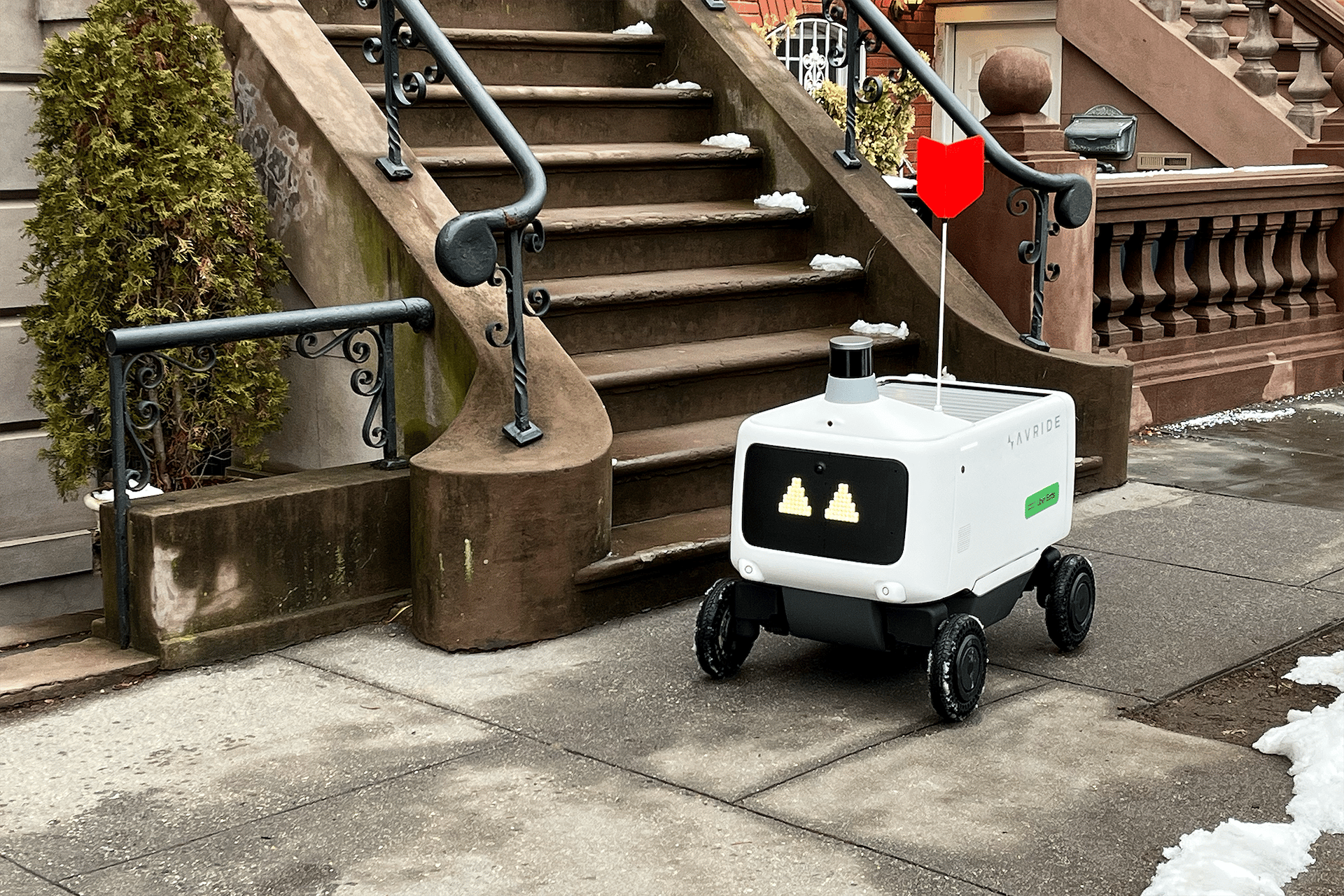

What distinguishes Avride from many autonomous vehicle competitors is its integrated approach combining both autonomous ride-hailing cars and sidewalk delivery robots under one AI-driven platform. Founded in 2020 by former Yandex engineers, Avride uniquely handles both passenger transportation and last-mile delivery, creating optionality in go-to-market strategy and revenue diversification.

This dual approach appeals to strategic partners like Uber, which operates both ride-hailing and delivery businesses through Uber and Uber Eats. A technology platform capable of supporting both use cases aligns well with Uber's broader business strategy and could eventually power autonomous operations across both segments.

The technical synergies between robotaxis and delivery robots are substantial. Both require sophisticated perception systems to navigate complex environments, path planning algorithms to optimize routes, and safety systems to handle edge cases. Avride's ability to leverage shared technology across both platforms potentially accelerates development timelines and reduces per-unit costs compared to companies focused exclusively on one modality.

Uber's Robotaxi Strategy

For Uber, the Avride investment represents a pragmatic approach to autonomous vehicles after the company sold its internal self-driving unit, Uber ATG, to Aurora in 2020. Rather than developing proprietary autonomous technology, Uber is pursuing a platform strategy, partnering with multiple AV companies to bring robotaxis onto its network.

This approach allows Uber to benefit from autonomous vehicle technology without bearing the full cost and risk of development. The company has announced similar partnerships with Waymo, Cruise, and other AV operators, positioning itself as the dominant ride-hailing platform regardless of which autonomous technology ultimately succeeds.

The Dallas launch will provide crucial real-world validation of the Uber-Avride partnership. If successful, it could serve as a template for rapid expansion to additional markets. Dallas offers an attractive testing ground with sprawling geography, significant ride-hailing demand, and generally favorable weather compared to more challenging environments like San Francisco or New York.

Autonomous Vehicle Market Dynamics

The autonomous vehicle sector has experienced significant consolidation and recalibration in recent years. After peak enthusiasm in the late 2010s, when companies routinely projected mass deployment within 2-3 years, the industry has adopted more measured timelines reflecting the technical challenges of achieving true autonomy.

Several factors explain this recalibration. Edge cases, unusual scenarios that autonomous systems must handle safely, prove far more numerous and complex than early projections anticipated. Regulatory frameworks remain incomplete, with most jurisdictions still developing rules for driverless operations. And unit economics, the cost per mile of operating autonomous vehicles, remains higher than human drivers in most markets, limiting commercialization opportunities.

Against this backdrop, companies like Avride benefit from strategic partnerships that provide both capital and distribution. The Uber partnership gives Avride immediate access to customer demand without building a consumer brand from scratch. Meanwhile, Nebius, itself a technology infrastructure company spun out of Yandex, brings technical expertise and potentially computing resources to support Avride's operations.

Technical and Operational Challenges

Scaling to 500 vehicles presents substantial technical and operational challenges. Each vehicle requires sophisticated sensor arrays including LiDAR, radar, and cameras, with hardware costs still measured in tens of thousands of dollars per unit. The vehicles need constant monitoring and remote assistance for edge cases, requiring operations centers staffed around the clock.

Fleet management at scale introduces additional complexity. Vehicles need maintenance, charging or refueling, cleaning, and repositioning to meet demand. Software updates must be deployed carefully to avoid introducing bugs that could compromise safety. And customer service operations must handle everything from pickup coordination to incident response.

Avride's experience operating delivery robots provides some operational learnings applicable to robotaxis. Both require fleet management systems, remote monitoring capabilities, and processes for handling exceptions. However, passenger transportation introduces higher stakes around safety and customer experience that demand additional rigor.

Market Implications

The $375 million investment signals continued belief in autonomous vehicles' eventual commercial viability despite slower-than-expected progress. Investors and strategic partners like Uber are taking a long view, betting that technical challenges will be solved and that autonomous vehicles will eventually prove safer and more economical than human drivers.

For Avride, the funding and partnership provide a clear path to scaled deployment. Unlike some AV companies operating in limited geographies with uncertain expansion paths, Avride has a strategic partner with nationwide presence and clear incentive to help the technology succeed.

The autonomous vehicle market opportunity remains enormous. U.S. ride-hailing revenue exceeds $40 billion annually, and removing driver costs could dramatically expand margins while potentially lowering consumer prices and increasing demand. Companies that successfully solve the technical and operational challenges stand to capture significant value.

Looking Ahead

The Dallas launch will serve as a crucial test of Avride's technology and the Uber partnership model. Success could lead to rapid geographic expansion and potentially additional funding to accelerate growth. Challenges or setbacks would likely result in more measured deployment timelines.

For the broader autonomous vehicle industry, Avride's progress offers another data point in the long journey toward scaled deployment. Each company's experience contributes to collective learning about what works, what doesn't, and how to navigate the path from technology demonstration to commercial operations