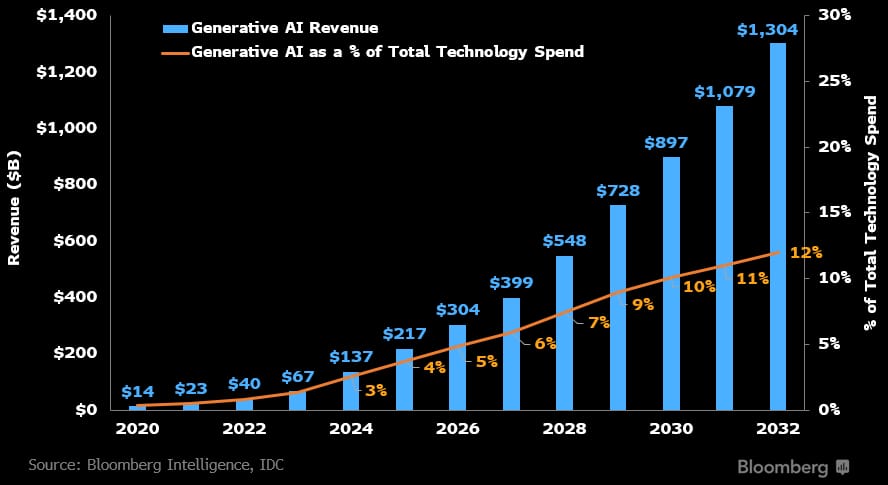

Bloomberg projects AI Spending to hit $1.3 Trillion by 2032

Big Tech capital spending is on track to exceed 500 billion dollars in 2026 as companies continue massive investments in artificial intelligence infrastructure despite mounting pressure to demonstrate returns. The spending represents a 36 percent year-over-year increase from 2025 levels according to CreditSights projections, with approximately 75 percent flowing directly into AI infrastructure.

The top five hyperscalers including Amazon, Microsoft, Alphabet, and Meta spent approximately 443 billion dollars on capital expenditures in 2025. CreditSights projects that figure will climb to 602 billion dollars in 2026, reflecting sustained confidence in AI's transformative potential despite profitability questions.

However, the current tech industry faces a critical challenge. While among the most profitable in history, not all companies have the cash on hand to cover the spend. The debt raise has been staggering with hyperscalers adding 121 billion dollars in new debt in 2025, more than four times the average annual issuance over the previous five years.

Meta tapped the bond market for 30 billion dollars while Alphabet raised 25 billion dollars. Over 90 billion dollars of total debt issuance came in just the final three months of 2025, signaling accelerated capital needs as AI projects scale.

Investors are beginning to scrutinize whether AI spending creates a circular economy where capital, capacity, and revenue recycle through the same small set of players. Critics argue the model works as long as growth holds but stress can propagate fast through a web of shared exposures if demand slips or funding tightens.

Nvidia is effectively financing demand for its own chips while Oracle builds deployment sites and AMD and Broadcom position as alternative suppliers. OpenAI anchors the demand side, creating interdependencies that concern market observers about systemic risk.

Already Nvidia has cautioned investors there is no assurance it would enter a definitive agreement with OpenAI or complete investments on expected terms. The disclaimer reminds markets that headline AI pacts often start as frameworks rather than binding commitments.

Markets showed early signs of nerves in late 2025 when Oracle's shares plunged after revealing spending had soared. Broadcom's stock dropped after warning its high profit margins would get squeezed. These incidents demonstrate investor sensitivity to AI investment efficiency questions.

Despite concerns, many analysts remain optimistic. The BlackRock Investment Institute says AI will likely keep trumping tariffs and traditional macro drivers. NatWest describes AI as a powerful engine of economic expansion while BCA Research stays neutral on stocks given AI's huge capital expenditure tailwind.

The biggest risk to us is not having exposure to this transformational technology according to JPMorgan Wealth Management. The statement reflects Wall Street's view that avoiding AI investment poses greater danger than participating despite uncertain returns.

Morgan Stanley forecasts AI adoption drives productivity increases that could lift potential economic growth. The firm projects continued moderate global growth in 2026 with AI outlays providing a capital spending boost across developed economies.

However, some economists warn the job market could remain muted as companies turn to artificial intelligence to improve productivity rather than hire additional workers. The tension between productivity gains and employment impacts presents policy challenges for governments.

Conservative investors are preparing for potential volatility by diversifying portfolios beyond AI concentration. Energy, commodities, and real assets provide hedges if AI valuations correct or infrastructure spending fails to generate expected returns.

The question facing markets is whether 2026 becomes the year AI spending translates into measurable revenue growth and profitability or whether valuations based on future potential face harsh reality checks.