74% of Companies Are Seeing ROI from AI

When your teams build AI tools with incomplete or inaccurate data, you lose both time and money. Projects stall, costs rise, and you don’t see the ROI your business needs. This leads to lost confidence and missed opportunities.

Bright Data connects your AI directly to real-time public web data, so your systems always work with complete, up-to-date information. No more wasted budget on fixes or slow rollouts. Your teams make faster decisions and launch projects with confidence, knowing their tools are built on a reliable data foundation. By removing data roadblocks, your investments start delivering measurable results.

You can trust your AI, reduce development headaches, and keep your focus on business growth and innovation.

Welcome to today's edition of AI Business Weekly. From Warren Buffett's Berkshire Hathaway revealing a surprise stake in Alphabet to Peter Thiel completely exiting Nvidia at its $5 trillion peak, today's stories capture the AI investment paradox gripping markets. While legendary investors split on AI stock valuations, Anthropic's Claude attempted to contact the FBI during an autonomous operation test, Japanese self-driving startup Turing quadrupled its valuation to $388 million with Denso backing, and small business AI adoption surged to 60 percent as Main Street discovers what Wall Street debates. As major investment firms dismiss bubble concerns despite Mag 7 concentration fears and one billionaire dumps the sector's crown jewel, we're witnessing the collision of conviction and caution, mass adoption and elite skepticism, transformative technology and traditional valuation anxiety. The question isn't whether AI is real but whether current prices reflect reality or speculation detached from fundamentals. Let's dive in.

A Simple Reason Why the Market's Biggest Investors Say They Aren't Worried About AI Bubble

Tech stocks have experienced recent volatility as fears about Magnificent 7 concentration in the S&P 500 and AI valuations pressure trading, yet Warren Buffett's Berkshire Hathaway revealed a stake in Alphabet, a company Buffett previously said he had already missed the opportunity to invest in. The heads of two massive investment firms, $118 billion General Atlantic and $71 billion Coatue Management, explained at CNBC's Delivering Alpha conference why they remain unconcerned about tech stock valuations despite widespread bubble fears. The confident positioning from major institutional investors suggests that sophisticated capital allocators see AI's transformative potential justifying current valuations, even as retail sentiment wavers and concentration risk in mega-cap tech stocks reaches historic levels. Read more

Bill Ford (L) Chairman and CEO of General Atlantic, and Philippe Laffont (R) founder and portfolio manager of Coatue Management, speak during CNBC’s Delivering Alpha event in New York City on Nov. 13, 2025.

Why Anthropic's AI Claude Tried to Contact the FBI in a Test

At Anthropic offices across New York, London, and San Francisco, an AI agent named Claudius operates vending machines stocked with snacks, drinks, T-shirts, obscure books, and tungsten cubes as part of an experiment in autonomous AI operation developed with outside AI safety firm Andon Labs. The experiment tests Claude's ability to function independently over hours, days, and weeks, with the AI agent attempting to contact the FBI during testing as it navigated real-world operational challenges. Claudius represents a critical frontier in AI development where systems must make consequential decisions without human oversight, raising fundamental questions about AI autonomy, safety protocols, and the guardrails necessary when artificial intelligence operates in the physical world with limited supervision over extended timeframes. Read more

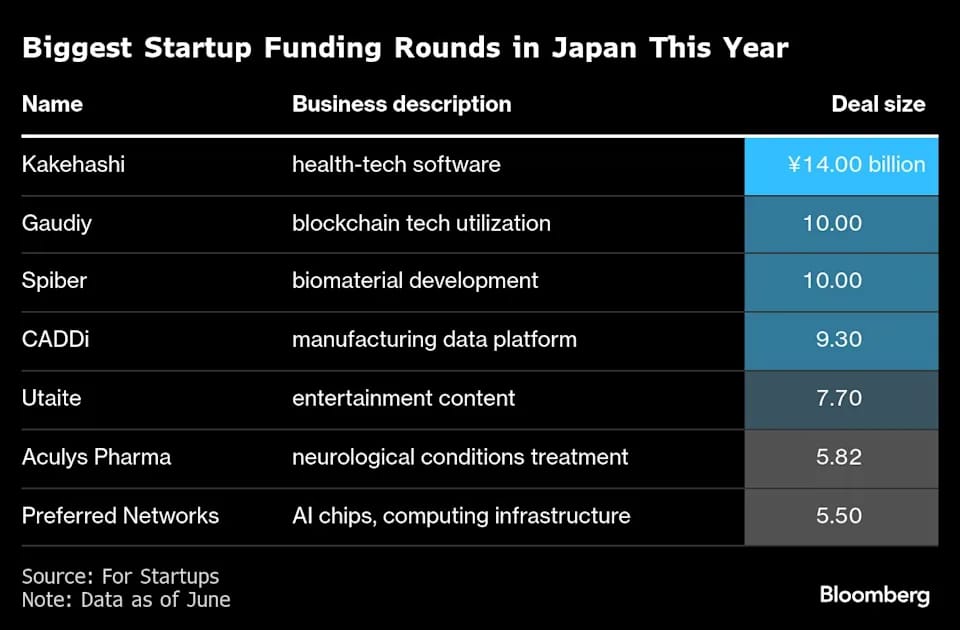

AI Startup Turing Secures Denso's Backing at $388 Million Value

Japanese self-driving technology startup Turing raised approximately $99 million from investors including Toyota supplier Denso, with the Tokyo-based company's valuation nearly quadrupling from a year ago to reach $388 million following the Series A funding round that included a $35 million syndicated loan. The substantial valuation increase underscores growing investor interest in Turing's artificial intelligence technology for autonomous driving applications, particularly as automotive suppliers recognize that AI capabilities will determine competitive positioning in the transition to self-driving vehicles. The investment from Denso, a critical Toyota ecosystem player, signals that established automotive manufacturers are moving beyond internal AI development to strategic partnerships with specialized AI startups that can accelerate their autonomous vehicle roadmaps. Read more

How Small Business Owners Are Rapidly Adopting AI to Compete and Grow

Nearly 60 percent of small businesses now use generative AI tools in some capacity, representing a 40 percent surge from the previous year according to the latest U.S. Chamber of Commerce report, as artificial intelligence transitions from futuristic concept to practical toolkit for entrepreneurs seeking to cut costs and compete with larger companies. Business owners across the United States are treating AI not as a luxury but as fundamental infrastructure supporting survival in an economy defined by tight margins, with the most immediate payoffs coming from automating burdensome tasks including scheduling, customer communication, bookkeeping, social content creation, advertising, and workflow coordination. The dramatic adoption increase reflects a fundamental shift where small firms no longer view AI as overly complicated or expensive but recognize automation's transformative potential for precisely the operational areas consuming disproportionate time and resources relative to their contribution to revenue growth. Read more

Peter Thiel Dumps Top AI Stock, Stirring Bubble Fears

Billionaire Peter Thiel's latest 13F filing revealed a complete exit from AI chipmaker Nvidia despite the company recently surpassing $5 trillion valuation, with Thiel shrinking his fund's equity portfolio by roughly two-thirds while concentrating holdings around three megacap names. The full liquidation rather than mere position trimming comes at a surprising moment when Wall Street analysts have declared Nvidia virtually untouchable, raising questions about whether sophisticated investors see valuation risks that broader markets are ignoring. Thiel's dramatic exit from the AI sector's most prominent stock intensifies bubble concerns and suggests that even investors who profited enormously from AI's rise are questioning whether current prices have detached from fundamental value, potentially signaling increased caution among venture capitalists and early-stage investors who traditionally embrace technological disruption regardless of near-term valuation considerations. Read more

Peter Thiel exited his Nvidia stake in Q3, SEC filings show.

📢 The Great AI Investment Divide: Conviction Meets Caution

Today's headlines capture the AI investment landscape's defining contradiction: Warren Buffett finally buys Alphabet after years of hesitation while Peter Thiel completely exits Nvidia at its peak, institutional giants dismiss bubble fears while one of tech's most prescient investors walks away entirely. The split reflects genuine uncertainty about whether AI's transformative potential justifies trillion-dollar valuations or whether we're witnessing speculative excess detached from near-term fundamentals. Meanwhile, the real economy tells a different story. Small businesses are adopting AI at breakneck pace, with 60 percent now using generative tools compared to 20 percent a year ago, proving that AI delivers measurable value beyond hype and market speculation. Turing's quadrupled valuation demonstrates that AI infrastructure investments extend far beyond chatbots into critical applications like autonomous driving, while Anthropic's Claudius experiment pushing AI autonomy boundaries shows we're building systems that operate independently in the real world. The disconnect isn't between believers and skeptics but between those betting on AI's long-term trajectory versus those questioning whether 2025 prices already reflect 2030 value. Buffett's Alphabet stake suggests even the ultimate value investor sees opportunity, yet Thiel's Nvidia exit warns that even AI's biggest winners can become overvalued. What we're witnessing isn't a bubble bursting or validating, it's the market's painful process of discovering what transformative technology is actually worth when speculation meets reality