Welcome

Welcome to today's edition of AI Business Weekly. From Michael Burry's explosive accusations of AI accounting manipulation to Meta losing its chief AI scientist, today's stories reveal the deep tensions emerging as the AI boom matures. SoftBank is doubling down—selling its entire $5.8 billion Nvidia stake to fund new AI bets—even as questions mount about whether returns can justify the capital tsunami. Meanwhile, Gamma's rocket ship to $2.1 billion valuation and $100 million ARR proves that amid the uncertainty, profitable AI companies do exist. And in a geopolitical twist, Kazakhstan is betting $2 billion on becoming Central Asia's AI powerhouse through a partnership with Nvidia and OpenAI. Let's dive in.

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

'Big Short' investor Michael Burry accuses AI hyperscalers of artificially boosting earnings

Michael Burry, the investor made famous by "The Big Short," is accusing some of America's largest technology companies of using aggressive accounting to pad their profits from the artificial intelligence boom. In a post on X Monday, the Scion Asset Management founder alleged that "hyperscalers"—the major cloud and AI infrastructure providers—are understating depreciation expenses by estimating that chips will have a longer life cycle than is realistic. The accusation comes as Burry recently roiled markets with a significant tech short position, suggesting he's betting heavily that AI infrastructure valuations are inflated. If Burry is correct, the accounting practices could be masking the true economics of the AI buildout and overstating near-term profitability. Read more →

Meta stock falls on news AI chief scientist plans exit

Meta Platforms stock dropped 1.5% in premarket trading following reports that the company's chief AI scientist, Yann LeCun, is planning to leave the tech giant. According to the Financial Times, LeCun—who has been instrumental in Meta's artificial intelligence initiatives—is in early discussions to raise funding for a new venture. The departure comes at a critical time when Meta has been heavily investing in AI capabilities across its platforms and recently announced ambitious infrastructure spending plans. LeCun's exit raises questions about continuity in Meta's AI strategy and whether other top AI talent may follow. Read more →

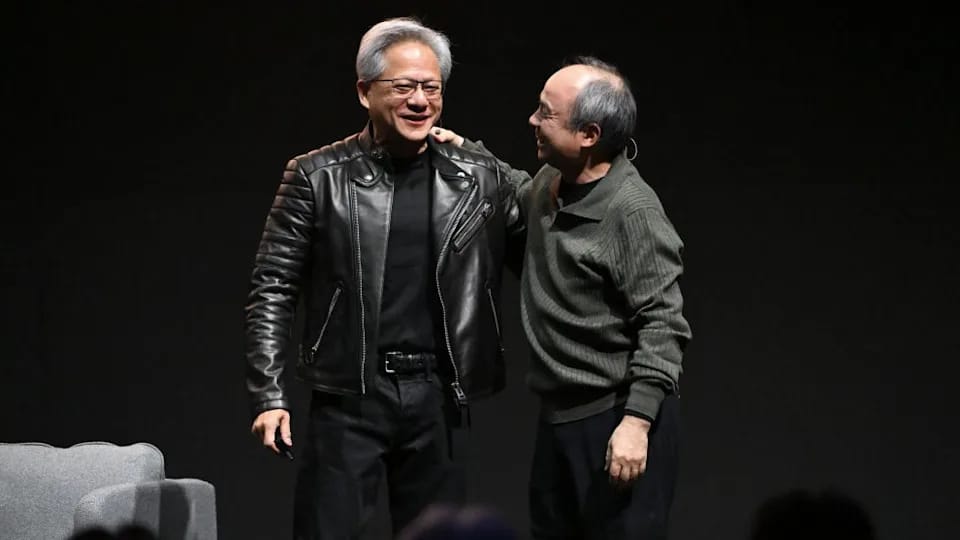

SoftBank sells Nvidia stake for $5.8 billion to fund AI bets

SoftBank Group sold its entire stake in Nvidia for $5.83 billion to help bankroll AI investments, even as investors question the amount of capital pouring into a technology with uncertain returns. The massive liquidation demonstrates SoftBank's conviction that direct AI investments will generate better returns than holding Nvidia shares, despite the chipmaker's dominant position in AI infrastructure. The timing is notable given Nvidia's stock has been one of the market's best performers, suggesting SoftBank sees even greater opportunities elsewhere in the AI ecosystem. The move also highlights how AI's capital demands are reshaping portfolio strategies across the investment landscape. Read more →

AI PowerPoint-killer Gamma hits $2.1B valuation, $100M ARR

Gamma, a startup that creates AI-generated presentations, websites, and social media posts, announced a $68 million Series B round at a $2.1 billion valuation led by Andreessen Horowitz. Co-founder and CEO Grant Lee posted on X that the company has profitably hit $100 million in ARR with 70 million users, after reaching $50 million ARR profitably in its first two years. The achievement stands in stark contrast to concerns about AI business models, proving that AI applications can scale rapidly to meaningful revenue while maintaining profitability. Gamma's success suggests that focused, productized AI tools solving specific pain points can command premium valuations even in a skeptical market. Read more →

Kazakhstan plans $2 billion AI center in partnership with Nvidia, Freedom Holding

Kazakhstan announced plans to create a Sovereign Artificial Intelligence Center, a landmark $2 billion initiative designed to accelerate the country's AI capabilities and strengthen its position as a digital leader in Central Asia. The ambitious project brings together Nvidia, Freedom Holding Corporation, OpenAI, and Kazakhstan's Ministry of AI and Digital Development in a partnership aimed at building one of Central Asia's most advanced AI infrastructures. The move reflects growing competition among nations to establish AI sovereignty and secure access to critical infrastructure, with countries beyond traditional tech hubs making major investments. Kazakhstan's bet demonstrates how AI infrastructure is becoming a strategic national priority globally, not just in the US and China. Read more →

📢 AI Market Trends

Today's developments capture an AI industry wrestling with its own success. Michael Burry's accounting fraud accusations against hyperscalers strike at the heart of AI economics—are infrastructure providers overstating profitability by understating how quickly their chips depreciate? Combined with Meta losing chief AI scientist Yann LeCun and SoftBank liquidating $5.8 billion in Nvidia shares despite the stock's stellar run, the signals suggest even AI bulls are questioning valuations and making portfolio adjustments.

Yet Gamma's profitable path to $2.1 billion valuation and $100 million ARR proves the skeptics aren't entirely right either. While infrastructure economics remain murky, focused AI applications are generating real revenue at impressive margins. The company's success with 70 million users shows that AI tools solving specific problems—in Gamma's case, replacing PowerPoint—can achieve both scale and profitability simultaneously.

The most intriguing story may be Kazakhstan's $2 billion sovereign AI center. As nations recognize that AI infrastructure is strategic national capacity, not just a tech investment, we're entering an era where geopolitical competition drives AI buildout as much as commercial opportunity. The question is whether this flood of capital—from nations, corporations, and investors—can generate returns that justify the spending, or whether Burry's short thesis will prove prescient.