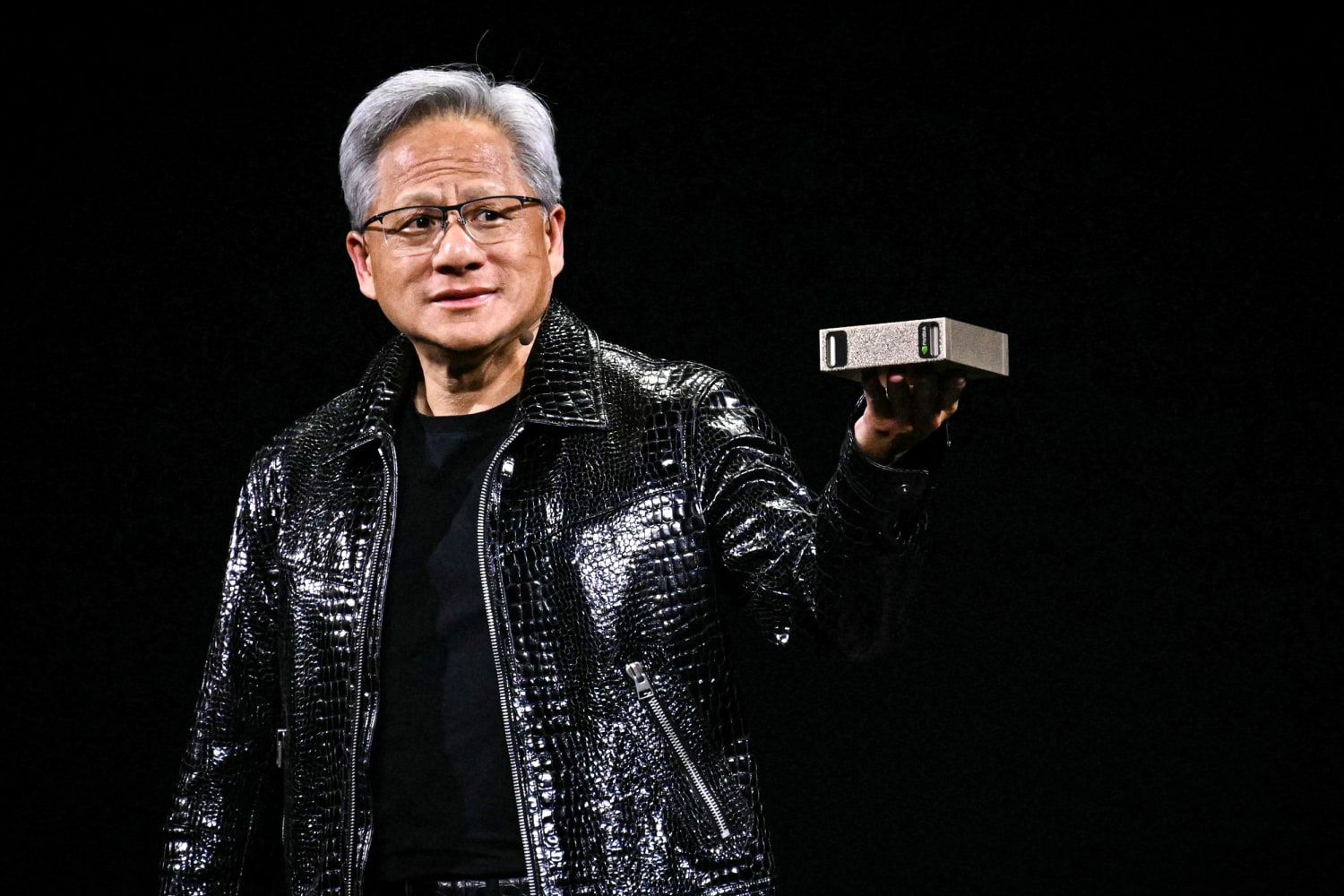

Nvidia CEO Jensen Huang

Nvidia CEO Jensen Huang is planning to travel to China in late January to attend company events ahead of the Lunar New Year holidays and potentially meet with senior Chinese officials as the semiconductor giant works to reopen access to one of its most critical markets for AI processors, Bloomberg reported Tuesday citing a person familiar with the matter. The visit comes amid regulatory confusion as the Trump administration formally approved sales of Nvidia's H200 artificial intelligence chips to China while Chinese customs authorities simultaneously instructed agents not to permit the chips to enter the country.

The trip represents Huang's latest effort to navigate complex geopolitical tensions between the United States and China that have created uncertainty for the world's most valuable technology company. Huang is expected to visit Beijing, though it remains unclear whether meetings with senior Chinese government officials will be confirmed. His plans could still change depending on whether prospective meetings materialize, according to sources.

Trump Administration Approval Followed by Chinese Import Block

Last week, the Trump administration formally approved sales of Nvidia's second-most powerful H200 artificial intelligence chips to China, a move expected to pave the way for shipments despite concerns from China hawks in Washington. The approval included a requirement that Nvidia accept a 25% reduction on such sales compared to standard pricing, representing a compromise between commercial interests and national security considerations.

However, Chinese customs authorities told customs agents on January 14—one day after the U.S. approval—that H200 chips were not permitted to enter the country, Reuters reported. This created immediate regulatory whiplash where Nvidia received U.S. government permission to export products that China's government simultaneously prohibited from import, leaving the company's market access in limbo despite apparent progress.

According to Bloomberg sources, Chinese authorities have notified the military, major government agencies, critical infrastructure operators, and state-owned enterprises not to use the H200 chip for security reasons. The Information reported that the Chinese government informed technology companies the H200 chip could only be used in special situations such as university research institutes, with vague guidance to purchase Nvidia chips only "when necessary."

Huang's Pattern of Lunar New Year China Visits

Huang has established a pattern of visiting China annually around the Lunar New Year holidays, typically attending company celebrations and meeting with business partners and government officials. Last January, he chose to travel to China instead of attending U.S. President Donald Trump's inauguration ceremony, signaling the priority Nvidia places on the Chinese market despite political optics.

During a previous visit to China in July, Huang successfully secured meetings with Vice Premier He Lifeng and Commerce Minister Wang Wentao—senior officials overseeing economic policy and trade relations. The access Huang achieved to high-ranking officials demonstrates China's recognition of Nvidia's strategic importance to the country's AI development ambitions and willingness to engage directly despite ongoing technology export restrictions.

Nvidia declined to comment on Huang's travel plans. Reuters could not immediately verify Bloomberg's report, and the company's practice of not confirming executive travel in advance leaves the visit's details uncertain until Huang arrives in China or company events are publicly announced.

Market Stakes: $50 Billion Annual Opportunity

Huang has previously estimated that the Chinese market for Nvidia's AI chips could be worth approximately $50 billion per year—none of which is currently included in Nvidia's financial forecasts due to export restrictions. At CES in early January, Huang told reporters that Nvidia is seeing "very high" customer demand in China for H200 chips and that the company has "fired up our supply chain, and H200s are flowing through the line."

Huang indicated at the press conference that Nvidia would know the regulatory status of chip sales as purchase orders materialize rather than through official announcements. "We're not expecting any press releases, or any large declarations," Huang stated. "It's just going to be purchase orders." He added that any H200 sales would be incremental to the $500 billion two-year revenue forecast Nvidia provided last year, suggesting "it appears that we're going to be going back to China."

This comment-driven market communication reflects the uncertainty surrounding chip exports to China, where regulatory approval can shift rapidly based on political considerations rather than following predictable policy frameworks. The lack of formal agreements or transparent processes creates volatility for both Nvidia's revenue projections and Chinese customers' procurement planning.

Anthropic CEO Criticizes Potential China Sales

The visit and potential chip sales have drawn sharp criticism from other AI industry leaders concerned about national security implications. Dario Amodei, CEO of Anthropic, delivered forceful criticism of U.S. policy changes allowing sophisticated AI chip sales to China, comparing the practice to "selling nuclear weapons to North Korea," according to Breitbart reporting.

Amodei's extreme comparison reflects growing divisions within the AI industry about appropriate export policies. Some executives prioritize commercial opportunities and argue that export restrictions simply cede market share to international competitors without meaningfully constraining China's AI development, while others view advanced chip exports as directly enabling potential adversaries' military and surveillance capabilities.

The debate mirrors broader tensions between Silicon Valley's global business interests and Washington's national security priorities. Technology companies argue that overly restrictive export controls harm U.S. competitiveness without preventing China from developing alternative semiconductor capabilities, while security hawks contend that maintaining technological advantages requires accepting commercial sacrifices.

Strategic Importance Amid Supply Chain Complexity

China represents a critical market for Nvidia beyond immediate revenue considerations. Chinese technology companies, research institutions, and government entities represent major customers for data center infrastructure, and maintaining relationships positions Nvidia for long-term market share as China's AI sector develops. Loss of access could accelerate Chinese efforts to develop domestic semiconductor alternatives, ultimately reducing Nvidia's global market dominance.

However, Nvidia faces execution challenges even if regulatory barriers clear. The company must navigate U.S. export licensing requirements, Chinese import restrictions, political pressure from both governments, and potential secondary sanctions on customers who deploy chips for applications either government deems problematic. This complexity creates operational overhead and uncertainty that competitors without similar geopolitical complications avoid.

The situation exemplifies how U.S.-China technology decoupling complicates global supply chains and forces companies to navigate contradictory regulatory requirements from two major economic powers. Huang's personal diplomacy—visiting China, meeting officials, attending company events—represents attempts to maintain relationships and signal Nvidia's commitment despite policy volatility.

Wall Street Remains Bullish Despite China Uncertainty

Despite uncertainty around China sales, Wall Street maintains bullish sentiment on Nvidia stock, driven by solid demand for the company's AI GPUs from customers outside China, continued innovation reflected in Blackwell and Rubin platform development, and expectations that China restrictions will eventually ease as both governments recognize mutual economic interests in technology trade.

Huang's scheduled appearance Wednesday at the World Economic Forum in Davos, where he will be interviewed by BlackRock CEO Larry Fink, provides a platform to address China strategy with global business leaders and potentially signal Nvidia's approach to navigating geopolitical tensions. The juxtaposition of Davos appearances and China visits illustrates Huang's balancing act between Western stakeholders and Chinese market access.

For Nvidia, success in China depends less on technology capabilities—where the company maintains clear advantages—than on diplomatic skill navigating political sensitivities while maintaining commercial relationships across increasingly hostile geopolitical divides. Huang's late January trip represents another chapter in this ongoing balancing act with billions in annual revenue hanging in the balance.